Bookkeeping

Connect your Amazon Business account to QuickBooks Online

Every time you make a sale or issue a refund, that transaction is recorded automatically, and the totals adjust. Not only does this accounting method save you a substantial amount of time and effort, but it’s unparalleled in its accuracy. You can also use an inventory management system like QuickBooks Commerce to assess which products are overperforming across existing channels. You’ll gain valuable insights into your best sellers so you can make informed business decisions.

Manually enter data from Amazon reports into QuickBooks Online

Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. As an industry-leading accounting software with a suite of commerce-focused products, QuickBooks enables sellers to automate eCommerce accounts and access daily financial reports. Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting.

- With Bench, you can dig into fully-featured financial reports any time you want to.

- This may not be beneficial for many businesses that just need standard data integration, but if you have a lot of unique requirements, the DIY route could be a very beneficial option.

- Your account will automatically be charged on a monthly basis until you cancel.

- Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada.

- There are many uniform standards when it comes to bookkeeping and accounting, but how do those standards apply to your specific business?

The Amazon Seller app can improve your performance

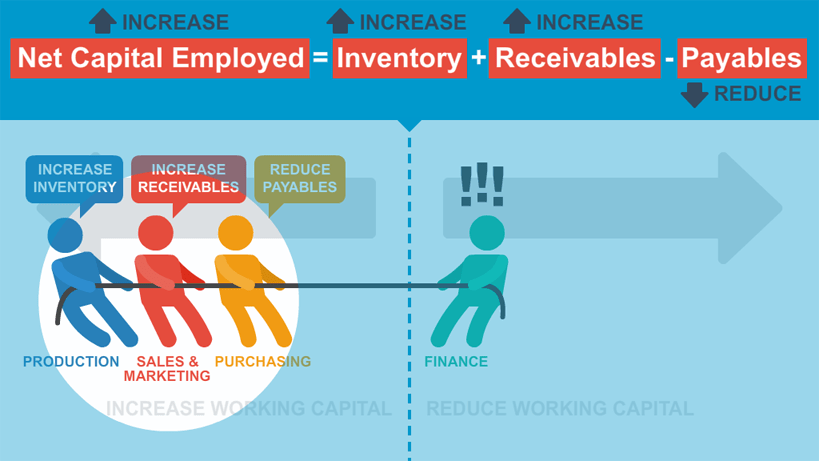

QuickBooks makes it easy to generate reports which means you can monitor your cash flow more efficiently so you can make informed business decisions. If you need to check to see if you hit your sales goals for the month, QuickBooks runs a report so you can view that data instantly with the click of a button. Once that goal is reached, you might want to order more inventory.

Tax Filing Assistance

● Saves Time – Using a direct integration service can save you tons of time that would otherwise be dedicated to manual data entry and ongoing data reconciliation. If you connect an app with a high volume of daily transactions, QuickBooks Online may freeze. To fix or prevent this from happening, you must change the sync options in the app to allow it to bring over a daily summary instead of individual transactions. Ability to split out transactionsA2X can split out the taxed, not taxed, and tax-exclusive transactions, which is crucial for ensuring you don’t over or understate your income and remain tax compliant. This can be a fiddly manual process, but A2X does it automatically.

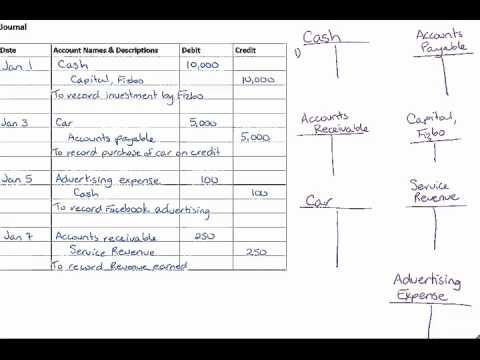

QuickBooks is an exceptional accounting system for viewing your bookkeeping numbers. So whether you don’t have it yet or are already using it and want to integrate it, let Unloop shed some light on what you can do to produce those numbers easily. With a single click you can quickly see your profit & loss, balance sheet, and dozens of other reports. Sync data from popular apps like QuickBooks Time, Shopify, PayPal, and many others.

QuickBooks for Amazon Sellers: Is DIY Worth it?

For instance, they may not accurately track the tax collected versus tax paid for Marketplace Facilitator Tax. And if they do offer tax functionality, it might be primarily focused on larger markets such as the USA, potentially complicating the process for international sellers. cost centre business wikipedia Order details are attached to the entryWhen doing your finances, it’s not necessary to bring in invoices for each individual sale. Doing this can swamp your accounting software, especially when your sales volume increases and you’re dealing with thousands of monthly invoices.

Contractor payments via direct deposit are $4/month for Core, $8/month for Premium, and $10/month for Elite. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. The discounts do not apply to additional employees and state tax filing fees. https://www.personal-accounting.org/understanding-bank-loan-covenants/ If you add or remove services, your service fees will be adjusted accordingly. To be eligible for this offer you must be a new QBO and Payroll customer and sign up for the monthly plan using the `Buy Now” option. Being in business—and doing it successfully—requires a lot of tax payments.

All of this will compound and the books will only get more and more inaccurate. Fast month-end closeUsing a data-syncing app can allow you to close off your month-end sooner, as you won’t be waiting for the settlement period to finish. The trade off to this is that it can create inaccurate financials that may over or understate your income. Customizable to what you needA2X is customizable to help you dig deep into your numbers exactly how you need to. Using A2X, you can split your sales by SKU or product type, if required.

You can enter employee hours on their own or provide them with access to enter their own time. Are you looking for an easy way to streamline bookkeeping? QuickBooks automates the process entirely so you can focus on other details.

This means a seller receives a single payment for sales made in both June and July. The seller then needs to split that payment out to figure out what fees and sales occurred in June versus July so their books stay accurate. A2X splits the settlement https://www.personal-accounting.org/ data, eliminating the need for a business owner or accountant to do it manually. ● Business Finance Tracking – QuickBooks offers a bevy of reports to help you track sales and expenses, ensuring that you’re staying on top of your cash flow.

The challenge with ecommerce accounting is that it is fundamentally different from any other type of accounting. Business planning is important for business owners who aim for growth. They’ll need a robust forecast of their potential income and expenses to plan well. Bookkeeping and accounting agencies understand this predicament. That’s why we handle the accounting aspects of your inventory to ensure you get the right COGS. This is crucial, especially when determining the correct net profit in your business’s income statement.

When used as routed, ottomax gentamicin sulfate lotion can supply relief from signs and symptoms as well as promote the healing of affected areas.